If you need additional loans for school where do you go - Getting through school is not that easy, in particular when you're short in your finances. Some students are left without a choice but to juggle work and school also. And clothing that doing this may not a super easy thing. On the same note, it is really a burden for folks to deny their obligation of sending their kids to highschool, just mainly because they do not have sufficient financial support. However, life has always something good to offer. It is within this light that education loan grants options are around for students aspiring for a school education.

The relationship is considerably more different with student loans. While there are several possible options that will help finance your education, or young kidseducation, these cannot always guarantee it will fully support your educational fees. Take savings as being an example. Saving normally takes time before it totals to the money you may need for education fees. Looking for college educational plans also is a huge gamble, as we have a battling global crisis as there is no assurance for the stability of educational plan companies these days. But education loan, it is certain that running without shoes can provide you with the educational fund that you need, without drilling a hole within your pocket.

To shed some light on student education loans and grants, you should know two different things. First is the fact, such loans were created with the institution that intend lending services; like banks and cooperatives. Banks follow certain rates for approving a student loan and they feature payment options that can be comprehensive. Second, student grants are made as subsidiary for educational support. These grant is not the same as trainees loan, as things are more competitive and it takes applicants to fulfill a certain criteria so as to avail the fund.

However, while these financial options quite appealing, theres really no such thing as free meal. To say the least, theres a simple pitfall behind these refinancing options; as this, in the end, is an economic loan. Like common financial loans, you can also be needed to your wages monthly dues and interest levels, which will be implemented according to the amount of your respective loan. For study grants, payment varies accordingly. In many instances, students have to work and render services to the institution; like doing its job student assistant to library, registrars office, computer room additionally,the likes.

Not surprisingly downside, the point that still remains; student loan grants for business financial choices to support university education. Its a thorough and reliable choice if you are running short on your own finances. These funding options opens the possibility for numerous individuals to pursue their dreams. It is usually not too difficult to acquire a school that accepts like funding method, as nearly any private or semi-private school entertains such educational funding. Provided that the career mover is advantageous their own tuition, there shouldnt sometimes be any problem traveling an even route to college education.

For anybody who is fighting so to speak, you most likely are wondering whats the subject matter best consolidation loan as a student?

After all, got to reimburse your school debt, you intend to make certain you still have sufficient money left on a monthly basis for rent or mortgage, food, utilities and incidentals.

Often it can be very tough to fit in those monthly repayments as well. Thats the place where finding the optimum consolidation loan for students comes in. If you can perform the research, you might be able to find one with a lower interest, a extended term and the payments will be lower each month. This means once you have refinanced that is recommended you can afford to your complete monthly expenses, as well as your loan repayment.

If you are interested in the informatioin needed for if you need additional loans for school where do you go, hopefully there are actually it below through the perfect pictures of so to speak.

Federal Student Aid On Twitter Thanks To Everyone Who.

(Photo : twitter.com)

Resources Federal Student Aid.

(Photo : studentaid.gov)

Loan Officer Job Description Salary And What To Expect.

(Photo : thetruthaboutmortgage.com)

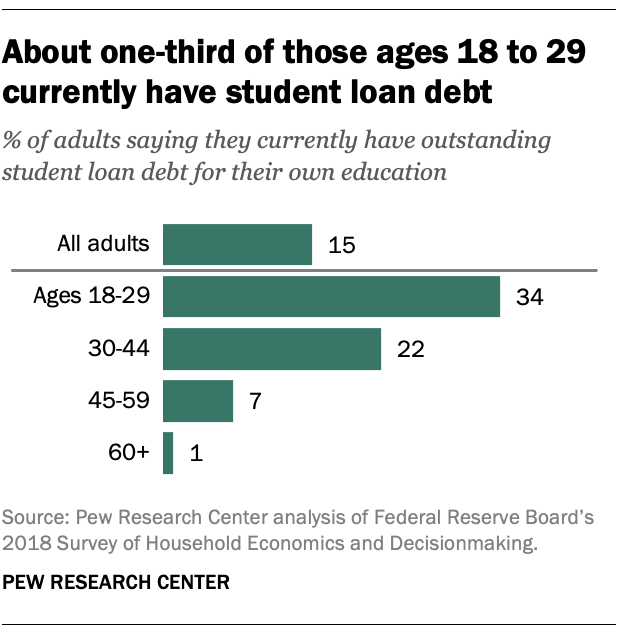

5 Facts About Student Loans Pew Research Center.

(Photo : pewresearch.org)

Calameo Student Loan Consolidation Guide.

(Photo : calameo.com)

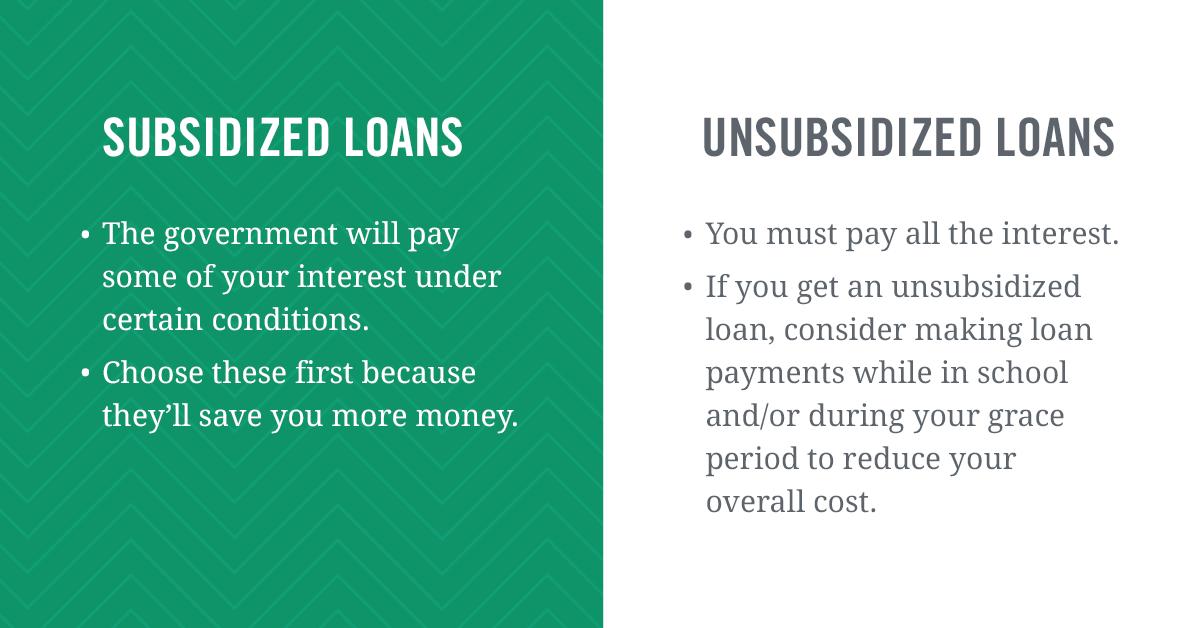

Top 5 Questions About Subsidized And Unsubsidized Loans Ed.

(Photo : blog.ed.gov)

What Are The Requirements To Get A Student Loan.

(Photo : thecollegeinvestor.com)

So where can you get a consolidation program? Well, it is possible to ask should never lender if you could refinance your school debt with them. Once you strike out with their company, you can also find some cool resources online that can probably help you. Like that, it is easy to research the whole set of programs that are around to ex-students who will be struggling with their debt.

When you have family or friends members which have consolidated their loans, you can inquire further who their lender is when theyre pleased with them. Word of mouth marketing is often a great referral tool. Immediately you are trying to earn your minimum monthly bills, if you live struggling for you to do so. This way, your credit history remains unblemished. You might have to cut out some entertainment options until youve consolidated, that include not looking into movies or out with friends so much.

You can always ask buddies in the future over to your house and request that they bring drinks or nibbles with them. Like this, you are not a lot poorer by purchasing food and drink to keep these things happy and putting yourself further into debt.

So when you want to find the best consolidation loan for a student, research useful online language learning resources together with asking your buddies and family. And dont forget to ask your current lender as well. Before you know it, its likely you have a higher price remaining in the bottom of every month because youve consolidated has given!

Thankyou for visiting this if you need additional loans for school where do you go, for more interesting topic related to loan information please bookmark this Update Loan website.

Post a Comment