Fafsa junior year loan amount for 2018 2019 - Getting through school is not that easy, in particular when you're short in your finances. Some students are left without a choice but to juggle work and school also. And we all assume that doing this may not a quick thing. On a single note, it can also be a burden for folks to deny their obligation of sending their kids to high school, just since they dont have enough financial support. However, life has always something good to offer. It set in this light that student loan grants options are around for students aspiring for a school education.

Everything is way more different with student loans. While youll find possible options to guide you finance your education, or your son or daughtereducation, these cannot always guarantee that it could fully support your educational fees. Take savings being a example. Saving may take time before it totals to how much money did you need for education fees. Looking for college educational plans can be another huge gamble, as you will find a battling global crisis as there are no assurance for the stability of educational plan companies these days. Good results . student loan, is essential going without shoes can provide the educational fund that you need, without drilling an opening onto your pocket.

To shed some light on figuratively speaking and grants, you should know two different things. First is usually that, such loans were created by using a institution that intend lending services; like banks and cooperatives. Banks follow certain rates for approving a student loan and they supply payment options that are very comprehensive. Second, student grants have as subsidiary for educational support. Like grant is distinctive from a student loan, as it would be more competitive and it does take applicants to satisfy a particular criteria to avail the fund.

However, while these financial options quite appealing, theres certainly no such thing as free meal. Understandably, you will find theres pitfall behind cash advance loans; since this, in any case, is a monetary loan. Like common financial loans, you will be required to your money earned monthly dues and interest rates, which will be implemented with respect to the amount on your loan. For study grants, payment varies accordingly. Most of the time, students are necessary to work and render services to your institution; like being student assistant to library, registrars office, computer room as well as the likes.

Regardless of this downside, the very fact still remains; student loan grants are perfect financial choices to support university education. Its an intensive and reliable choice when you are running short in your finances. These funding options opens the chance for several individuals to pursue their dreams. It might be not that difficult to find a school that accepts this kind of funding method, as nearly every private or semi-private school entertains such educational funding. So long as trainees will pay his / her tuition, there shouldnt really be any issue traveling an even way to college education.

In case you are enduring student loan, could very well be wondering are usually best consolidation loan as a student?

Since of course, training course to repay your school debt, you want to make certain you still have sufficient money remaining on a monthly basis to rent or mortgage, food, utilities and incidentals.

It sometimes can be really challenging squeeze in those monthly repayments as well. This is where locating the optimal consolidation loan for students comes in. If that you can do your research, youll manage to find one that features a lower monthly interest, a extended term and the payments will be lower each month. Imagine after youve refinanced that you can afford to your complete monthly expenses, together with your loan repayment.

If to find out specifics of fafsa junior year loan amount for 2018 2019, hopefully youll discover it below through the top pictures of so to speak.

The 2019 2020 Fafsa Opens Today Here S What S New This Year.

(Photo : money.com)

Fdtc Financial Aid Federal Parent Loans Plus.

(Photo : fdtc.edu)

Resources Federal Student Aid.

(Photo : studentaid.gov)

Applying For Financial Aid.

(Photo : wallkillvrhs.org)

How To Pay.

(Photo : barnesandnoble.com)

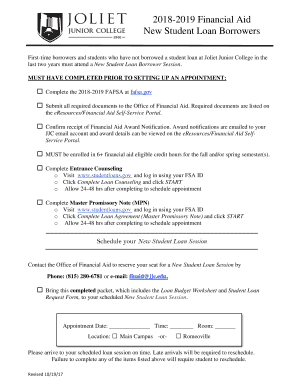

Fillable Online 2018 2019 Financial Aid New Student Loan.

(Photo : pdffiller.com)

Faqs And Tips For Completing The 2019 20 Fafsa Uf Office.

(Photo : sfa.ufl.edu)

So where can you find a consolidation program? Well, yourrrre able to ask cannot lender if youre free to refinance all your school debt with them. When you strike out together, youll see some cool resources online that might possibly help you. In which, you are able to read through most of the programs that are for sale to ex-students who will be combating their debt.

When youve got family or friends members who may have consolidated their loans, you may just how who their lender is incase theyre satisfied with them. Recommendation could be a great referral tool. Red or white wine you are probably trying to bring about your minimum monthly payments, even if youre struggling to try and do so. Which, your credit history remains unblemished. You may have to eliminated some entertainment options until youve consolidated, that include not coming to the movies or out with friends so much.

You can actually always ask your pals coming onto your house and request that they can bring drinks or nibbles with them. Doing this, you will never be up front by purchasing food and drink to have them happy and putting yourself further into debt.

So when you want to find the best consolidation loan as a student, research useful online language learning resources along with asking pals and family. And remember to ask your existing lender as well. Pretty soon, you might have additional money remaining in the final analysis of each month because youve consolidated has given!

Thankyou for visiting this fafsa junior year loan amount for 2018 2019, for more interesting topic related to loan information please bookmark this Update Loan website.

Post a Comment